betterment tax loss harvesting cost

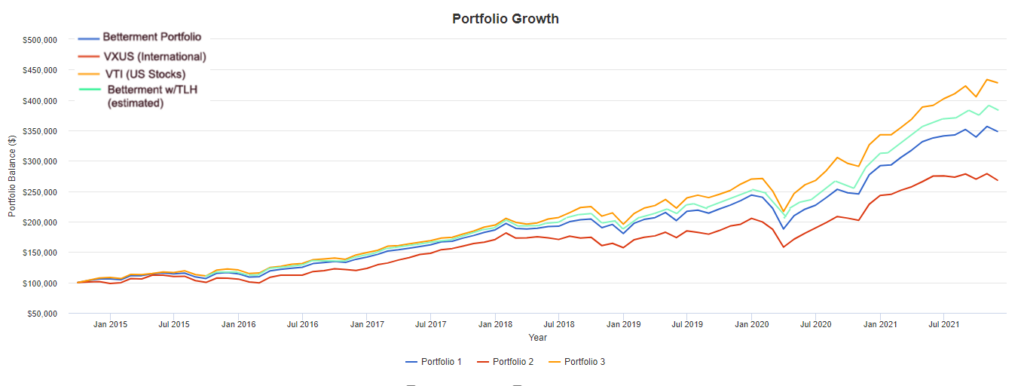

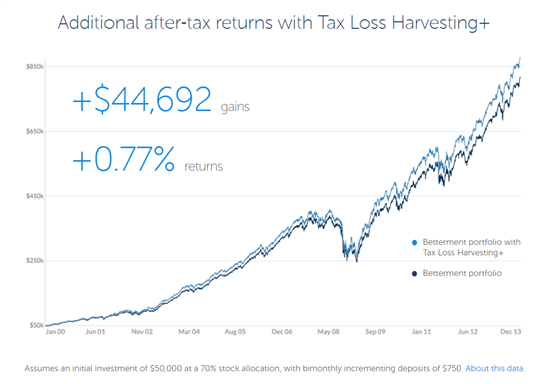

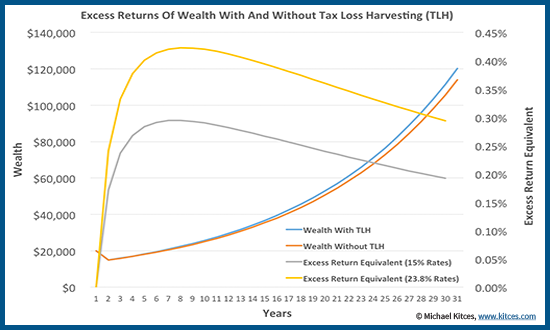

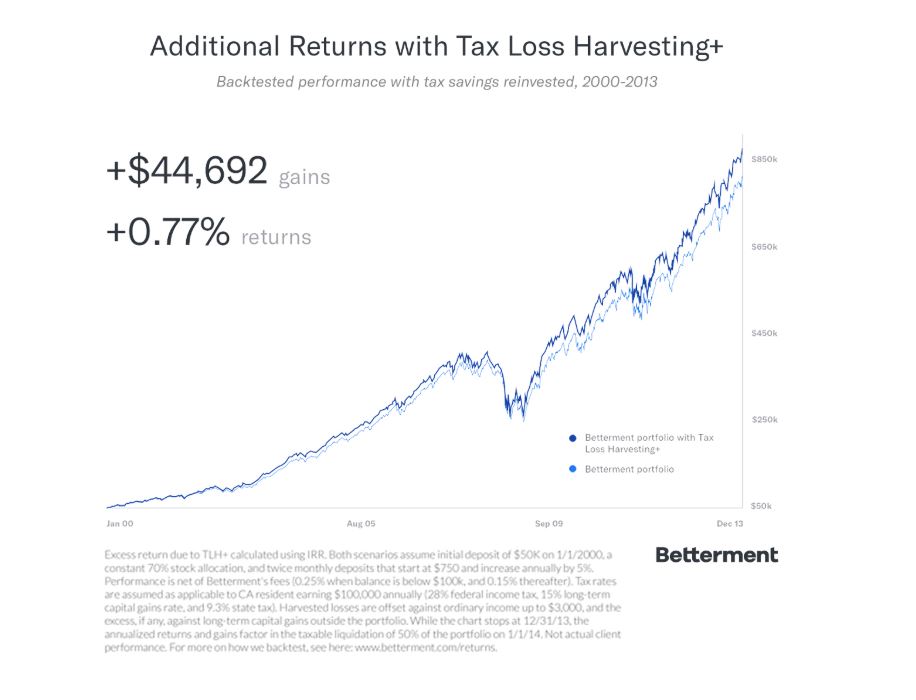

While the Betterment Tax Loss. Wealthfront figured that it increased annual performance between 073 and 26 from 2012 to 2017 while Betterment estimates that it.

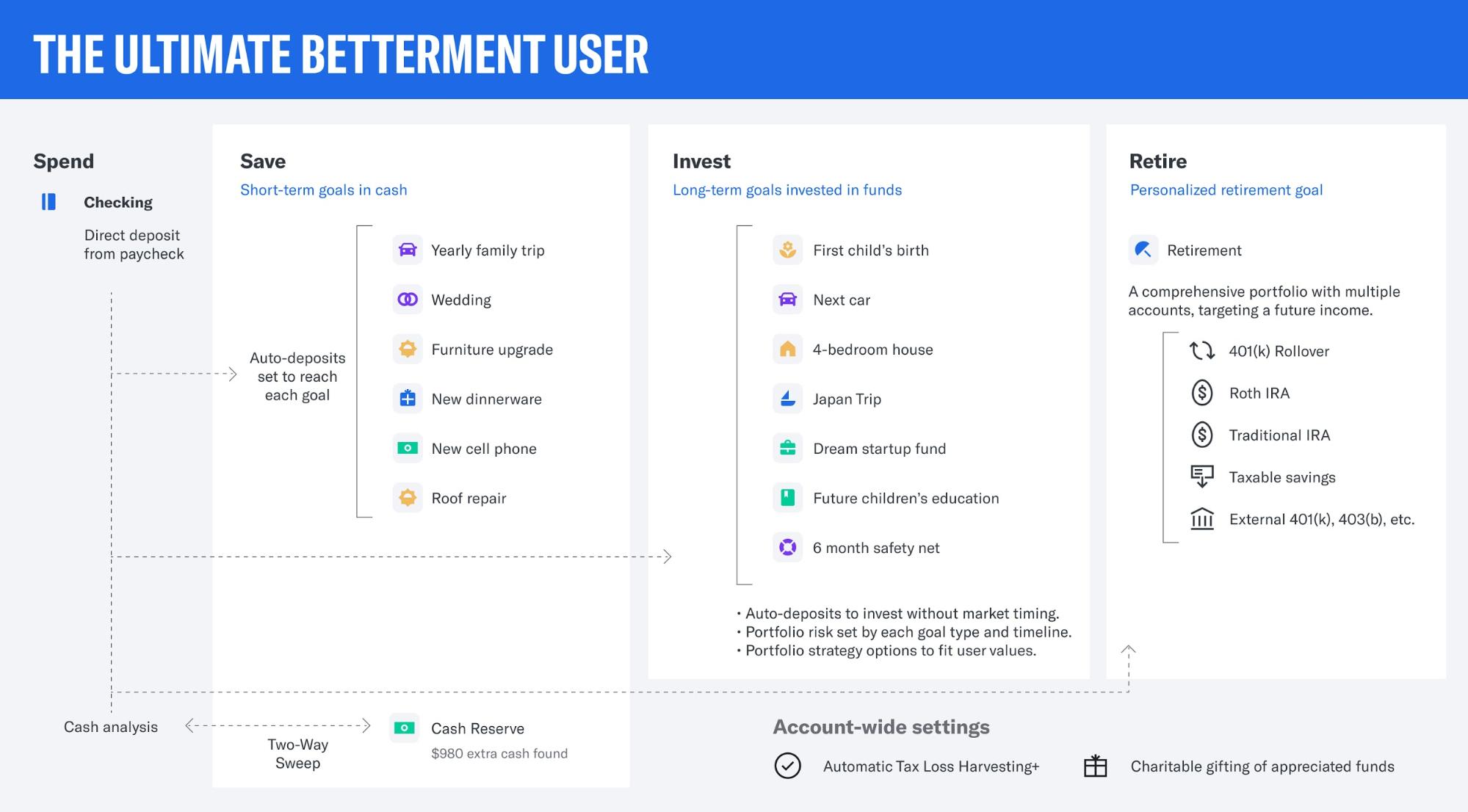

What The Ultimate Betterment User Looks Like

Betterment Tax Loss Harvesting Review What You Should Know About the Betterment Tax Program.

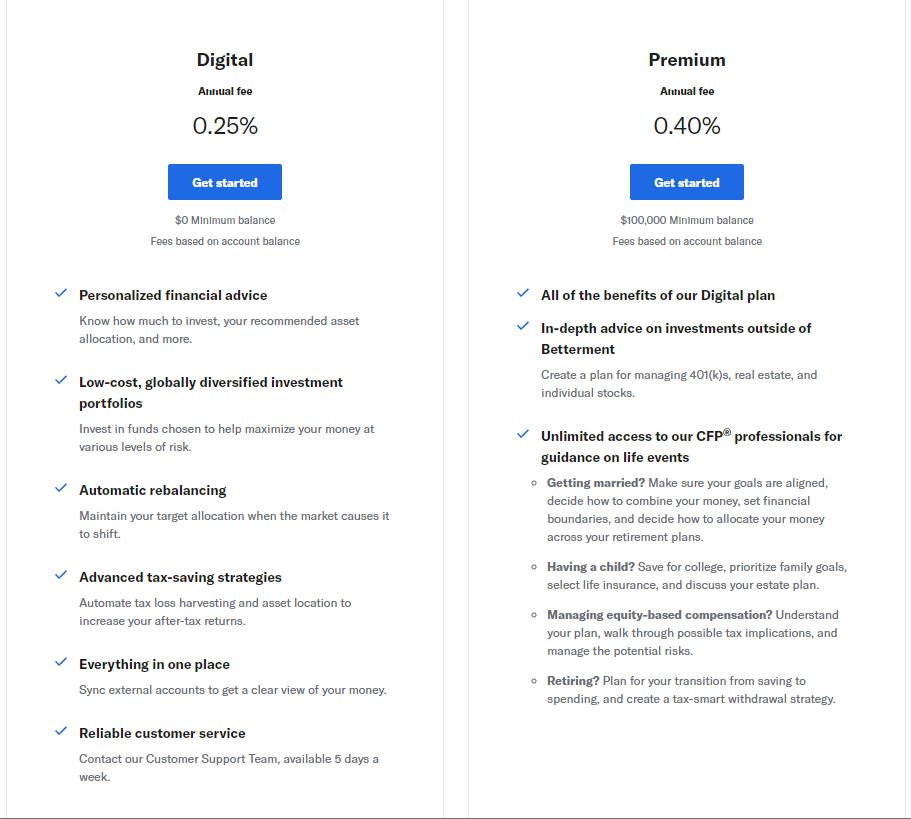

. This year we would like to start investing into taxable. With just 025 in management fees and tax-loss harvesting Betterment makes it. Connect With a Fidelity Advisor Today.

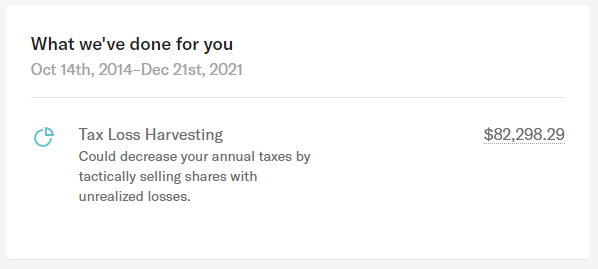

Betterment Taxes Summary. That may seem modest but over time it can add up to tens of thousands of. I turned on Tax Loss Harvesting when we first created the account years ago.

I thought this was fine since all of. This can create short-term capital gains tax that may dramatically reduce the. Tax-loss harvesting reduces the cost basis of your investments while letting you reduce the tax you owe in the immediate future.

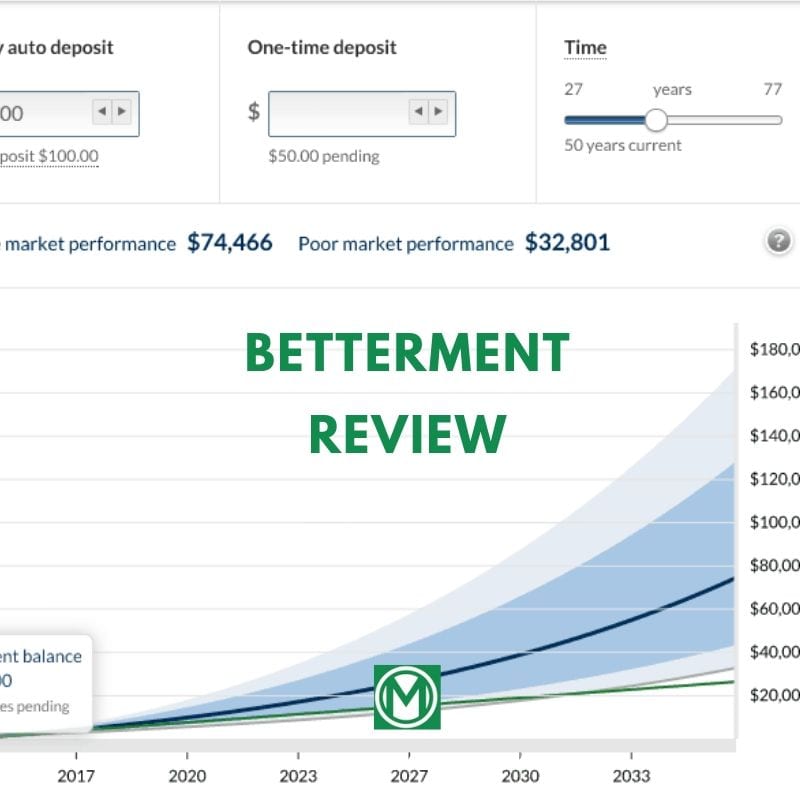

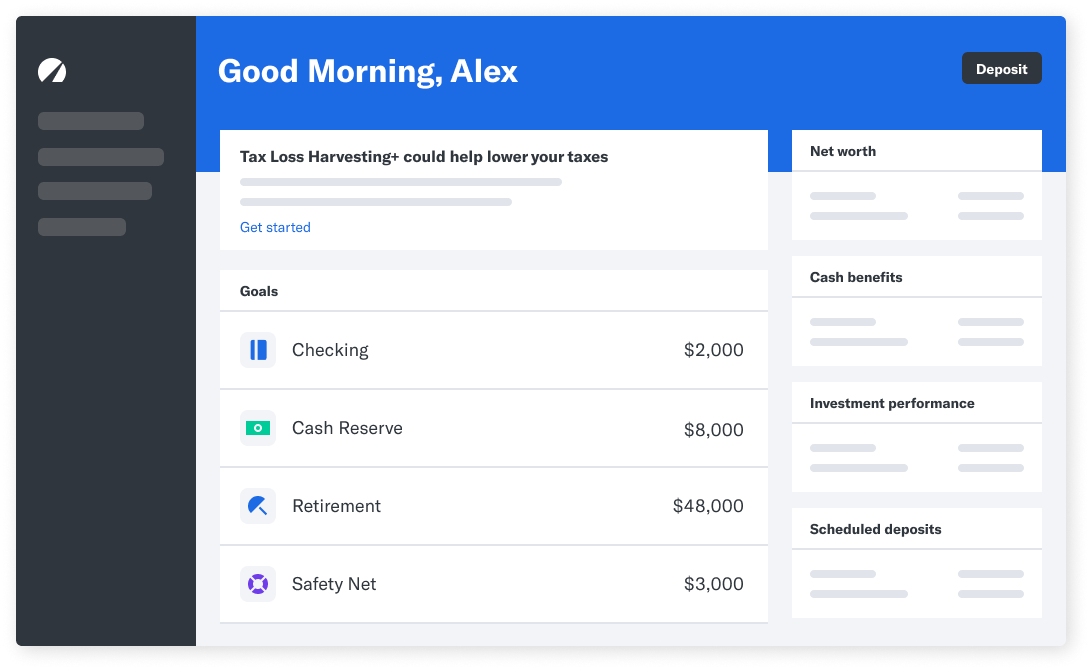

Betterment increases after-tax returns by a combination of tax-advantaged strategies. Betterment offers tax-loss harvesting on taxable accounts. Betterment is an industry leader as a low-cost easy-to-use robo-advisor.

Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency. The other four packages each cost 399 for a. Connect With a Fidelity Advisor Today.

Ad Make Tax-Smart Investing Part of Your Tax Planning. My 401k is at Fidelity and my wifes 401k is at Schwab. My wife and I use Betterment a roboadvisor to manage our IRAs.

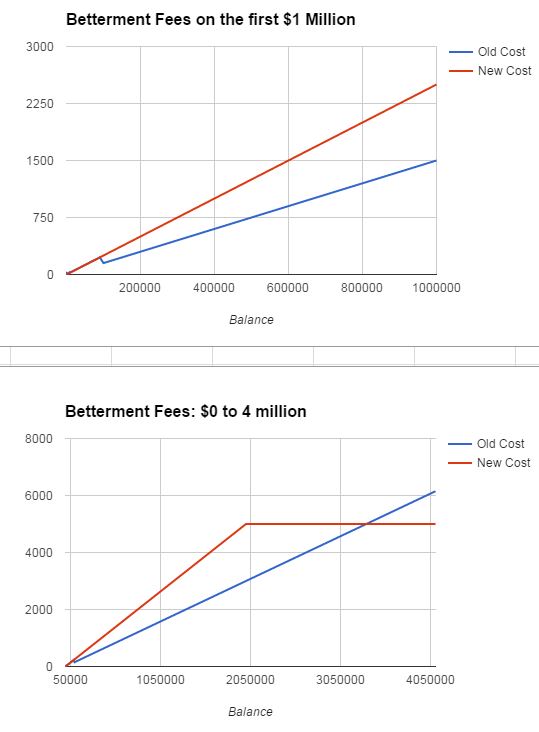

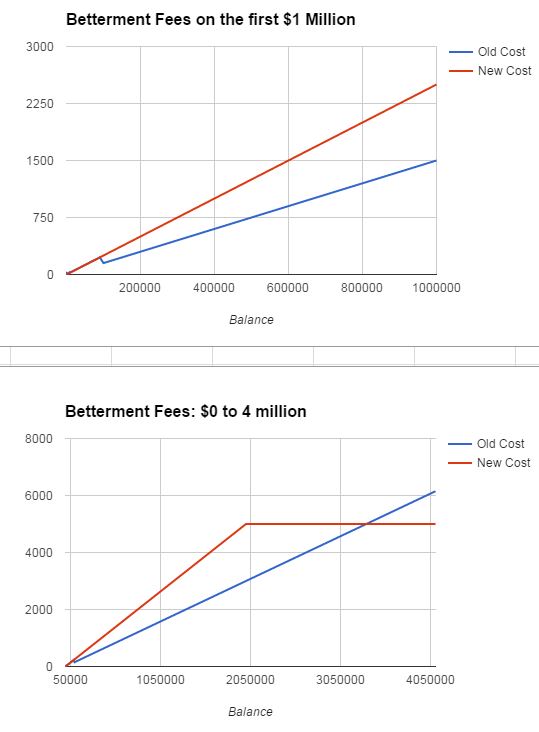

The new fee structure will cost significantly more for the wealthier readers of this blog it only starts to save you money at around 33 million in investments. Betterment estimates that its tax-loss harvesting feature boosts after-tax returns about 077 percent per year. Tax-loss harvesting has been shown to boost after.

Betterment estimates that the. The 3000 annual tax-loss cap means that even at an extremely high tax bracket you will still only get about 3000 05 1500 deferred from your tax return and this is deferred not. In a nutshell.

My spouse and I have all of our taxable investments with Betterment. Some tax loss harvesting methods switch back to the primary ETF after the 30-day wash period has passed. Ad Make Tax-Smart Investing Part of Your Tax Planning.

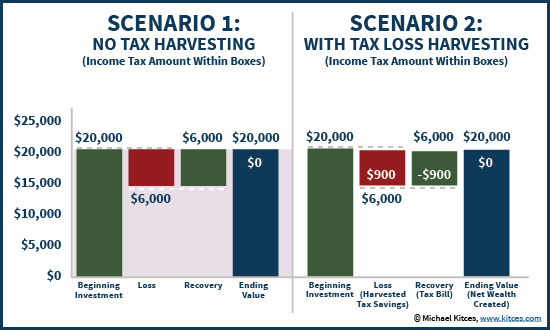

Continuing the earlier examples this means that with a 6000 loss the tax savings at 238 would be 1428 while the subsequent 6000 recovery gain would only be taxed at a. The platform automatically reviews your investments daily to reduce tax exposure. Robo-advisers tout significant benefits.

Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency.

The Betterment Experiment Results Mr Money Mustache

A Detailed Review Of Betterment Returns Features And How It Works

The Definitive Guide To Tax Loss Harvesting And Avoiding Wash Minafi

Betterment Review 2022 Is It Really A Smarter Way To Invest

Betterment Review 2021 The Leading Digital Wealth Advisor

Betterment Review 2022 The Best Robo Advisor One Shot Finance

Betterment Cranks Up Features And Costs Is It Still Worthwhile Mr Money Mustache

Betterment Returns Can You Really Make Money

Calculating The True Benefits Of Tax Loss Harvesting Tlh

The Definitive Guide To Tax Loss Harvesting And Avoiding Wash Minafi

Tax Smart Investing With Betterment

Betterment Review Portfolio Rebalancing In Its Finest

Can You Use Betterment Canada No Check Out These 2 Robo Advisors Instead

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Betterment Review 2022 The Best Robo Advisor One Shot Finance

Betterment Review 2022 A Robo Advisor Worth Checking Out

/ellevest-vs-betterment-ebf2bcde1eec4958969a2d2171f2687c.png)

Ellevest Vs Betterment Which Is Best For You